KINGSTON, JAMAICA – NOVEMBER 5, 2019 – Western Union, a leader in cross-border, cross-currency money movement and payments, today unveiled a new payment option that allows Amazon.com customers in Jamaica to pay in local currency for their Amazon.com purchases. The new payment option, brought to Jamaica in alliance with Bill Express, an affiliate of Western Union Agent GraceKennedy Money Services (GKMS), enables customers to shop Amazon.com’s vast product selection and pay in cash at Western Union® Agent locations across the country.

Western Union’s platform is powering Amazon’s new cross-border payment option, called Amazon PayCode, by processing the complex foreign exchange, settlement and money movement requirements for international e-commerce transactions.

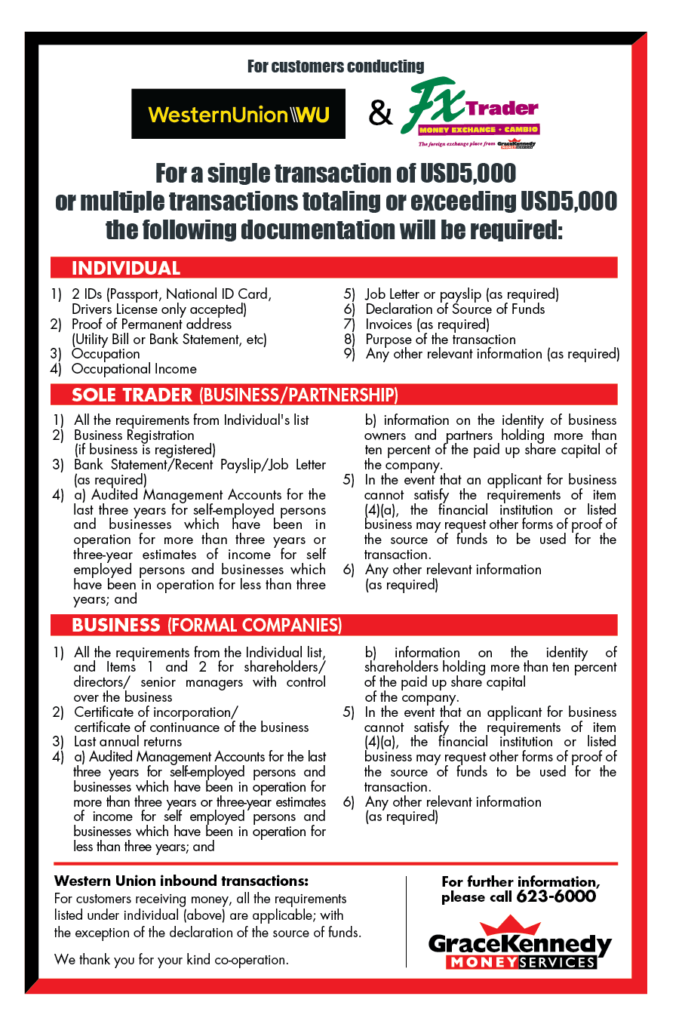

The new payment option makes it easy for more customers to shop Amazon.com and the Amazon mobile app. After selecting PayCode on the Amazon checkout page, customers will be sent a code, along with instructions on how to pay in person at any participating Western Union Agent location. The move by Western Union and Amazon provides greater access to online goods for customers who have largely been excluded from e-commerce shopping due to lack of accepted payment methods.

Expanding Customer Access and Closing the Payments Gap

According to Forrester Research, cross-border shopping will represent 20% of e-commerce by 2022, with sales reaching $630 billion. Choice, quality and cost are the main motivations for customers to shop online from overseas, but there are challenges and concerns about the lack of payment options for those who prefer to pay in person or those who do not have access to international credit cards or debit cards.

“We’re helping to unlock access to Amazon.com for customers who need and want items that can only be found online in many parts of the world,” said Khalid Fellahi, Western Union Consumer Money Transfer President. “This is a great example of two global brands innovating and collaborating to bring customers more convenience and choice. In a world where cross-border buyers and sellers are often located on different continents and in completely different financial ecosystems, our platform is ideally suited to solving the complexity of collecting local currency and converting it into whatever currency merchants need on the other end.”

“GKMS, Western Union’s agent in Jamaica, is pleased to once again partner to unlock new possibilities. Jamaicans are very familiar with ordering online and the opportunity to be able to facilitate improved access to these online purchases via Amazon.com is a significant boost. We still have a number of our consumers without a debit or credit card and this move will certainly add value to the digital journey that we are creating for our various customer segments,” says GKMS President & CEO Grace Burnett. “Through this partnership between Western Union and Amazon, all Jamaicans will now have access to the millions of products offered by Amazon and have the ability to pay for their items with cash through the premier money transfer service in the world at participating locations island-wide.”

“Amazon is committed to enabling customers anywhere in the world to shop on Amazon.com, and a big part of that is to allow customers to pay for their cross-border online purchases in a way that is most convenient for them”, said Ben Volk, Director, Payment Acceptance and Experience at Amazon. “Amazon PayCode leverages the reach of Western Union to make cross-border online shopping a reliable and convenient experience for customers who do not have access to international credit cards, or prefer to pay in cash.”

For more information, visit: Western Union payment option (westernunion.com/paylocal/jm); Amazon PayCode (https://www.amazon.com/paycode).

About Western Union

The Western Union Company (NYSE: WU) is a global leader in cross-border, cross-currency money movement. Our omnichannel platform connects the digital and physical worlds and makes it possible for consumers and businesses to send and receive money and make payments with speed, ease, and reliability. As of September 30, 2019, our network included over 550,000 retail agent locations offering our branded services in more than 200 countries and territories, with the capability to send money to billions of accounts. Additionally, westernunion.com, our fastest growing channel in 2018, is available in 75 countries, plus additional territories, to move money around the world. With our global reach, Western Union moves money for better, connecting family, friends and businesses to enable financial inclusion and support economic growth. For more information, visit www.westernunion.com.

Media contacts

|

Western Union Paula Barifouse +1 786 857-5175 |

Amazon Nick Caplin +44 (20) 3680 2144 |